Primer

Almost all of the ideas I share have a social arbitrage element or catalyst. It is not the driver of this idea but it does give some tailwind to it. Most know by now that the rental car market has been red hot recently, and the only way that was reflected in the markets up until now was through Avis, Hertz’s main competitor, and the only other publicly traded rental car company. With Hertz recently emerging from bankruptcy and the market still hot, Hertz is of course coming back to a favorable environment. While it helps, that information has already been processed by the markets and is not the center of focus, but rather a complementary part of the idea. In what is seen as a rare event in bankruptcies, old Hertz shareholders did not see their stock become worthless. They received a package of cash, new Hertz shares, and warrants to the new stock. The warrants are where the opportunity lies.

Bankruptcy Package

For those who don’t know how warrants work:

“A stock warrant gives the holder the right to purchase a company's stock at a specific price and at a specific date. A stock warrant is issued directly by the company concerned; when an investor exercises a stock warrant, the shares that fulfill the obligation are not received from another investor but directly from the company.” -Investopedia.com

Here is what old Hertz shareholders received upon exiting bankruptcy:

This means if you had 100 shares of HTZGQ (old stock), you received

9 shares of new stock (HTZZ)

65 warrants (HTZZW)

$153 cash

The warrants are the bulk of the package and have more favorable terms compared to most cases. HTZZW has 30 years to maturity, while Occidental Petroleum (who emerged from bankruptcy last year in a similar fashion) issued warrants with 7 years to maturity. The warrants have a strike price of $13.80.

The Opportunity

The main focus is the warrants. They are important in three ways:

They give investors possibly a cheaper way to participate in the recovery of the company.

They currently look fairly undervalued themselves.

They could rise as HTZZ shares become easier to borrow and sell short.

1) With the current stock price of HTZZ at $19.80 and the warrant exercise price of $13.80, the warrants have $6 of intrinsic value, or the profit one could make from exercising the warrant and then selling it. That means with the warrants currently trading at $9, warrant buyers are paying roughly $3 of premium. This is very low given their extremely long maturity. Hertz is returning to a hot rental car market with a balance sheet better than its competitors. Before Covid, Hertz had a lot of debt but it was manageable. Sure they could’ve been a little more prepared, but the business was not in a downturn prior, and without Covid, Hertz likely doesn’t go bankrupt. This is likely why private equity firms helping Hertz out of bankruptcy continuously outbid each other, and as a result, provided compensation for old shareholders.

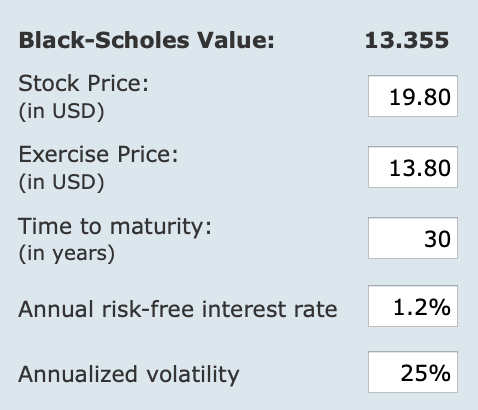

2) Black-Scholes models are used to value options, but with warrants being nearly identical, let’s take a theoretical look. We’ll use 1.2% as the risk-free rate (current 10Y treasury yield) and 25% for annualized volatility representing half of Avis’s volatility to be conservative.

This would give the warrants a theoretical value of $13.36 and nearly 50% upside. If rates and volatility rise, so would the Black-Scholes value. Even though this is theoretical pricing, I still believe the difference between fair value and current value provides a large enough margin of safety and a favorable risk/reward ratio. You can use this simpler model with your own inputs here.

3) The new stock (HTZZ) is not that freely tradeable yet. The majority of shares are still owned by the PE firms. Around 14 million shares of HTZZ were issued to old shareholders compared to 88 million warrants. This explains the volatile trading of both securities over the past week. Because of this, HTZZ is extremely hard to short, and with some brokers, impossible to short. This means that hedgers cannot sell the stock short and then buy the warrants to be protected yet. If the float opens up and pros end up trading this scenario, it could put a lot of upward pressure on the warrants. In this environment, heavily shorted stocks have been squeezed routinely by retail investors and it wouldn’t be crazy to think it could happen here, especially with a well-capitalized company with good prospects.

The Bottom Line

For those familiar with Hertz, you’re probably used to poor management, capital structure, and spending. These things have all changed now for the better. Hertz now has little to no debt (compared to Avis’s $3B of debt) and has come out of bankruptcy leaner than ever. This thesis is a compilation of a handful of ideas:

Hertz is returning to the most favorable rental car market in recent history.

HTZZW is theoretically far undervalued.

The low float of HTZZ shares could send HTZZW high if shorts pile into the stock.